Smarter Search: How AI Understands Meaning, Not Just Keywords

In the world of Private Equity, where every deal starts with insight, the ability to find and connect relevant information quickly is becoming a competitive edge. Whether you're sifting through CIMs, legal docs, old due diligence reports, or internal memos, the challenge is the same: how do you surface what actually matters?

That's where semantic search enters the picture, utilising cosine similarity.

From Keywords to Meaning

Traditional search tools look for exact matches: type "HVAC" (Heating, Ventilation, and Air Conditioning) and the tools will find documents with the word "HVAC." But what if a CIM talks about "climate control systems" without using the word "HVAC"? Traditional search misses it. Semantic search, on the other hand, understands meaning.

It does this by converting documents and queries into vectors, which are long strings of numbers called embeddings. These embeddings represent the semantic content of the text.

Then comes the magic.

Cosine Similarity: Measuring the Angle of Meaning

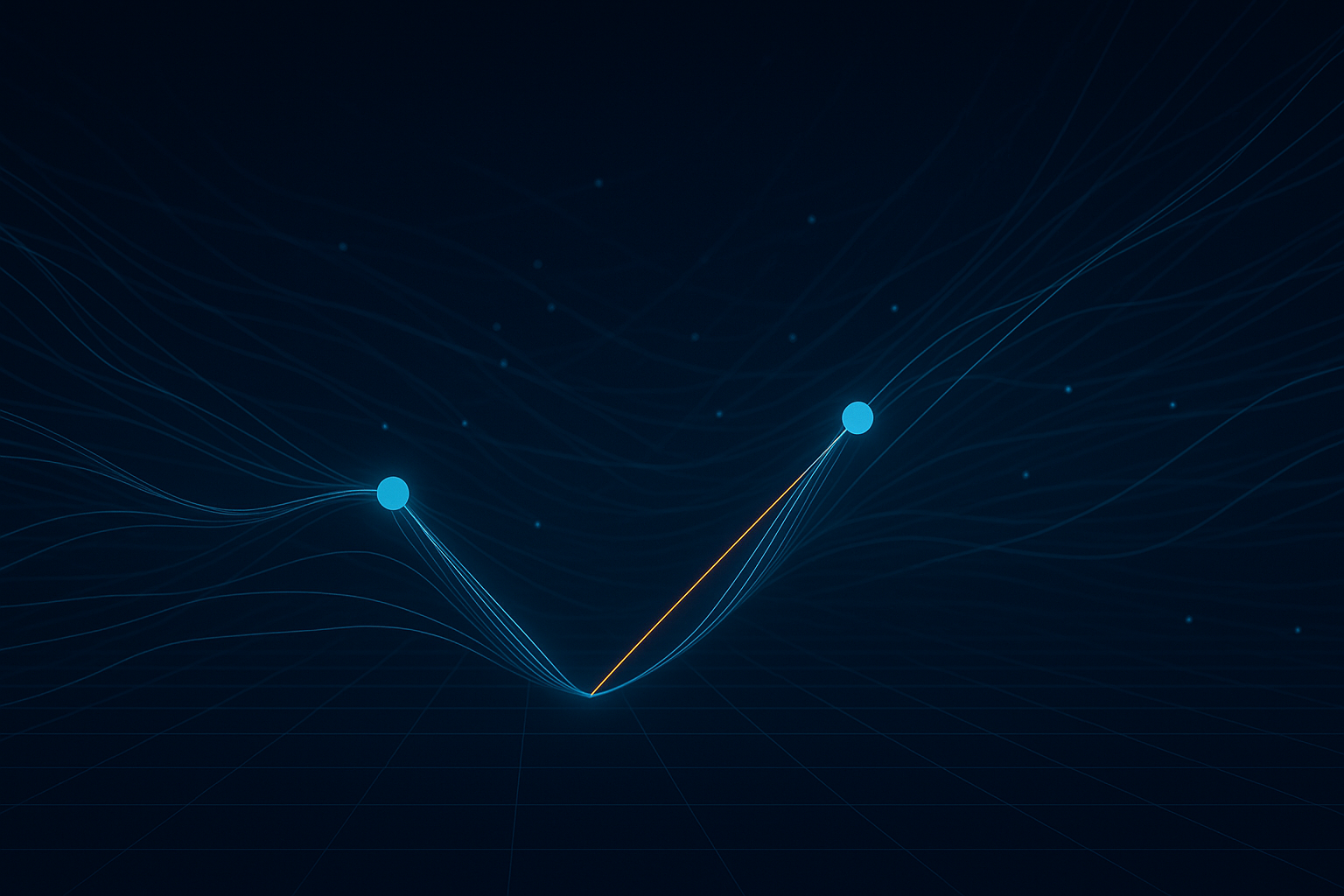

Once your documents and queries are turned into embeddings, AI can measure how close they are — not in terms of word overlap, but in conceptual alignment.

This is done using cosine similarity, which looks at the angle between two vectors:

- A small angle → very similar meaning

- A large angle → different concepts

So if your deal team is searching for "platform bolt-ons in renewable heating," cosine similarity might surface older deals described in completely different terms — like "biofuel HVAC retrofits" — because their meaning is aligned.

Why It Matters for M&A and PE teams

In an industry where:

- Institutional memory is buried in file drives

- Deal flow depends on pattern recognition

- And speed-to-insight drives competitive advantage

Semantic search becomes more than a technical curiosity. It's really a force multiplier.

Use cases we see in M&A teams include:

- Surfacing old diligence findings that mirror risks in current targets

- Quickly retrieving relevant metrics from internal archives

- Matching bolt-on candidates based on qualitative fit, not just NACE codes, revenue or EBITDA metrics

The Bottom Line

In a landscape where M&A is the growth engine, firms that adopt smarter, more meaningful ways to search and reuse their knowledge will have an edge.

We're building solutions that bring this power to dealmakers — not with jargon, but with practical tools that help you find what matters, faster.

If you're curious about how this could fit into your workflow, we'd be happy to help. Hit the Request a Demo button below to schedule a meeting, or drop us an email at contact@valuesync.ai and we'll contact you shortly.